Sending e-invoices – laws vs. reality

When Estonian companies were given the legal basis, or the right, to demand e-invoices from sellers in July 2025, it seemed like a logical step in the development of a digital country. Paperless processes, digital signatures, automatic tax calculation. Everything indicated that e-invoices should have long been the new normal. However, the reality is a little different. And the law change didn't change the reality. Or did it?

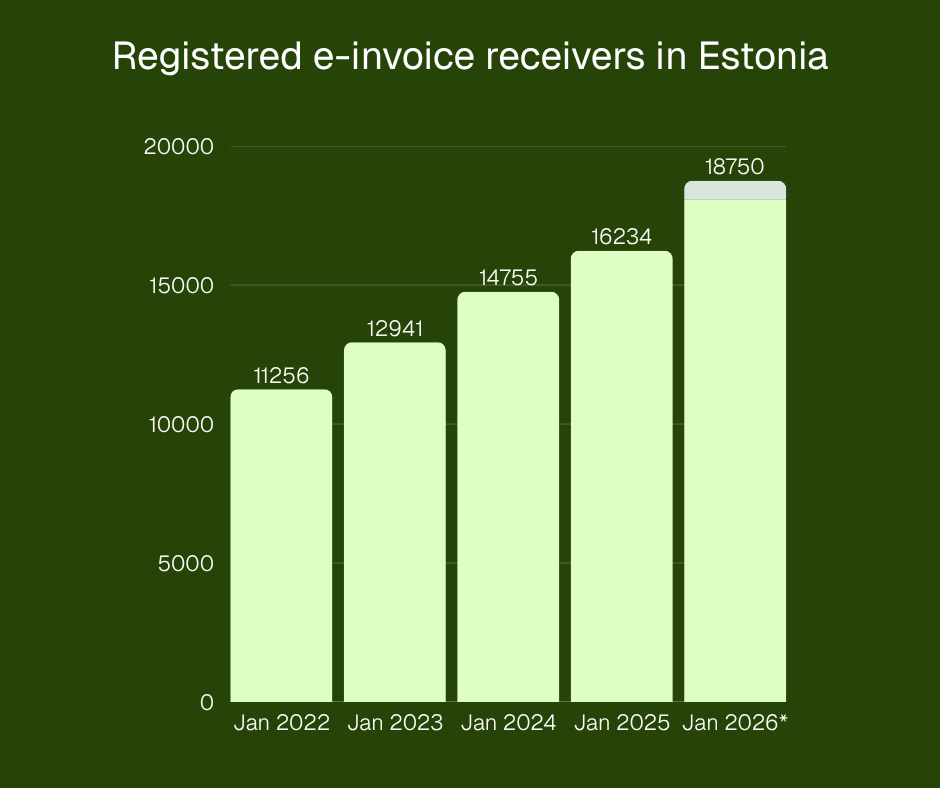

The number of e-invoice users is growing, with a few hundred companies registering to receive e-invoices every month. However, this does not mean that everyone has switched to completely digital processes. Many companies still use PDF and e-invoices interchangeably, which is a sign that development is taking place, but habits do not change overnight.

Digital laws ≠ digital habits

The law may provide a right and technology may create an opportunity, but it will not immediately change people's habits or ways of working if there are not enough convenient solutions.

Even in Estonia, where digital literacy and awareness are high, many companies still rely on fairly inefficient processes — PDF invoices, emails, attachments, and manual data entry. This may seem “good enough,” and in many cases it works, especially for smaller businesses. However, transitioning to e-invoicing requires changes not only in processes and workflows but often also in mindset. The technical readiness is already there, but behavioral change takes time.

E-Invoicing: Where Do We Actually Stand?

Although e-invoices have been available in Estonia for years, a complete digital revolution in business-to-business invoicing has not yet occurred. According to the latest data, business-to-business (B2B) e-invoicing accounts for around 23% of the total volume of invoices exchanged. However, only around 11% of active companies accept e-invoices.

*2026 forecast.

This shows that e-invoicing is gaining traction, but widespread adoption remains slow. Most companies still operate in a hybrid model, sending some e-invoices while continuing to receive invoices as PDF attachments via email. E-invoices can be sent without being received, and this is usually where smaller companies start.

It is important to note, however, that interest in e-invoicing has clearly increased. This is where many companies take their first step towards digital invoicing. Once this step is taken, adoption and automation follow, which brings even greater benefits.

Change is driven by larger companies, with smaller ones adapting in response

When comparing the volume of e-invoices with the number of recipients, it becomes clear that the transition is being driven by companies with higher invoicing volumes — those who also stand to benefit the most from adopting e-invoices. For these organizations, an efficient and automated invoicing process is essential to maintaining productivity and reducing manual work.

These companies are the primary adopters and promoters of e-invoicing, often integrating the solutions directly into their accounting and business systems. When a large or technologically advanced company begins requiring e-invoices from its partners, it naturally encourages suppliers to take their first step toward adoption. In this way, the shift to e-invoicing spreads organically across business networks.

Convenient and free e-invoicing is the foundation for progress

Based on Bilnex's experience, companies' interest in sending e-invoices has clearly grown, because more advanced companies have also started to require them from sellers by law.

Why e-invoicing? Because it's the easiest part of the process, and doesn't require major changes. You don't need to redesign the system or create new interfaces, just a convenient and understandable tool.

When sending e-invoices is free, intuitive and fast, it becomes a natural step, not an empty obligation. Estonia has proven that a digital nation can be built from the top down, but real change starts with the users of digital solutions.

Habits can be changed through rules and regulations, but the new way must be easier and better than the old one. Once creating and sending an e-invoice becomes faster and more convenient than attaching a PDF to an email, widespread adoption will happen naturally. It’s also worth noting that sending PDF invoices currently doesn’t appear to incur additional costs for companies. That’s why free and easy-to-use e-invoicing solutions play a key role — they clearly demonstrate both time and financial benefits compared to traditional methods, without requiring extra investment from businesses.

What’s the way forward: enforcing change or making it effortless?

The Estonian e-invoicing ecosystem is growing steadily, even if progress remains gradual. Each new company that begins sending or receiving e-invoices adds momentum to the digitalization of accounting and helps normalize the real-time economy. The next major leap forward won’t come from new legislation, but from tools that make e-invoicing simpler and more convenient than the traditional PDF-based process.

Bilnex aims to make e-invoicing so simple and intuitive that it becomes a natural part of everyday business. Our goal is to make sending e-invoices as easy as possible for small and start-up companies, providing the same convenience as sending PDFs — without complicated settings, confusing interfaces, or extra costs. That’s why Bilnex allows you to create and send both e-invoices and PDFs in just minutes from a single, user-friendly platform — completely free of charge. The system even automatically detects whether the recipient expects an e-invoice or a standard PDF for each invoice you create.

In addition, users can provide feedback to help shape a solution that truly meets their needs. After all, the most effective digital transformation doesn’t come from pressure — it happens when tools are designed around the people who use them.