Quick answers for your questions

Find all the essential information and answers to the most frequently asked questions about Bilnex right here.

Account creation and settings

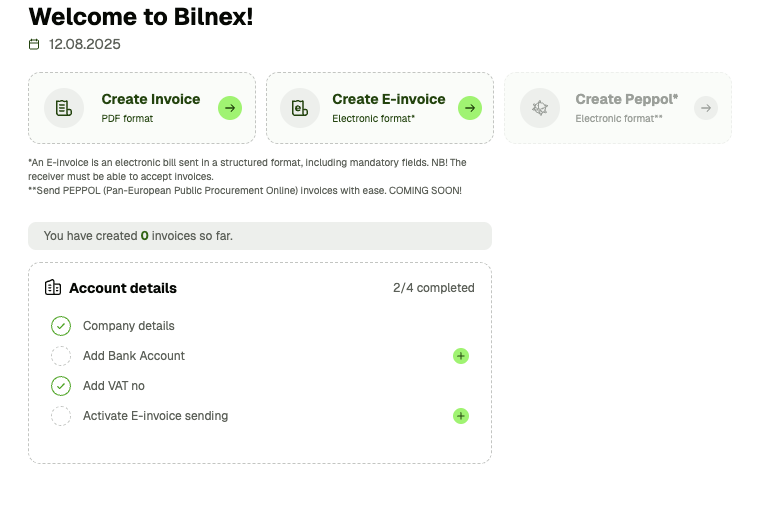

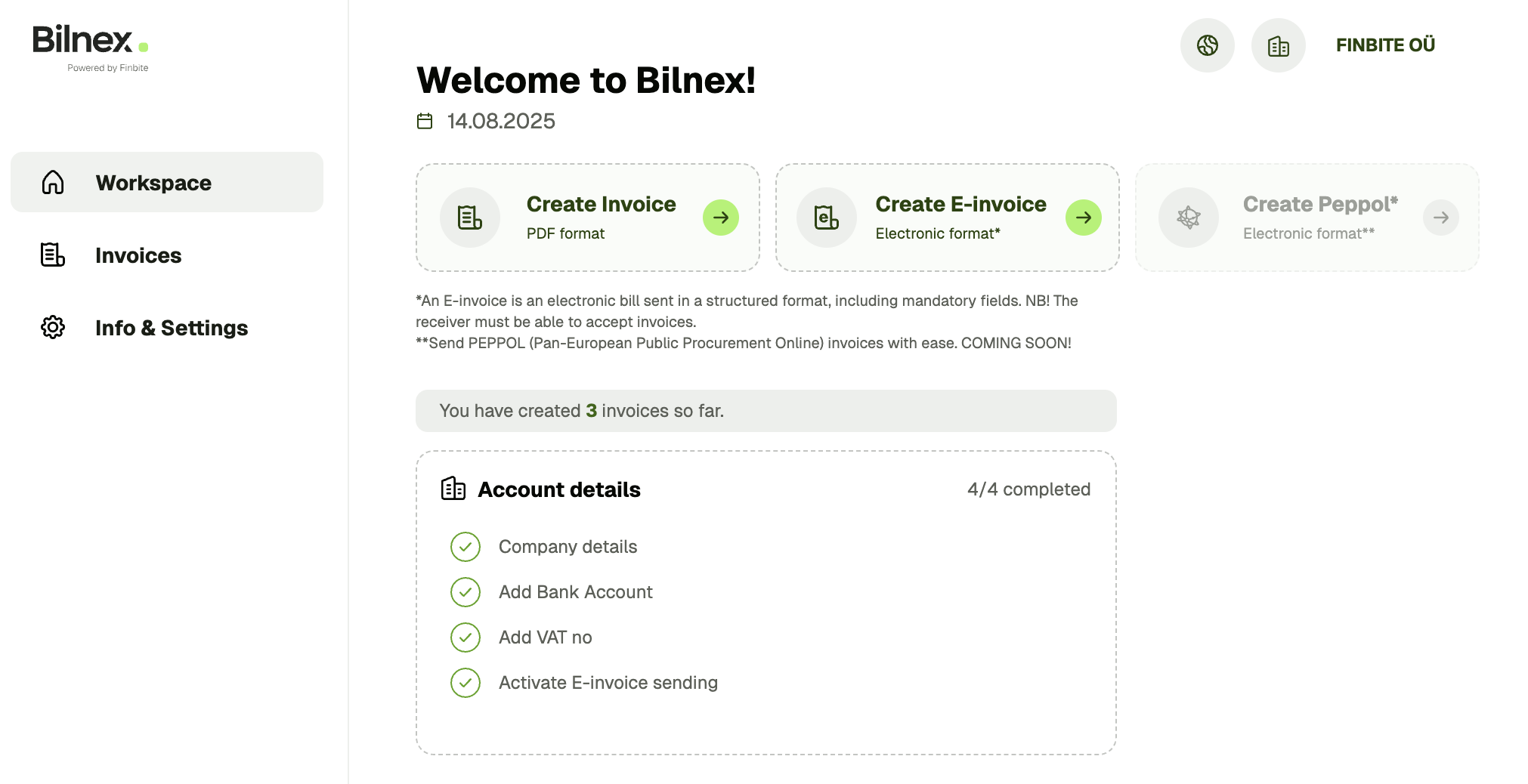

Getting started with Bilnex is easy. Here you'll find answers to common questions about creating and setting up an account so you can get started quickly and send your first invoices.

It's quick and easy, as the whole process only takes a few minutes.

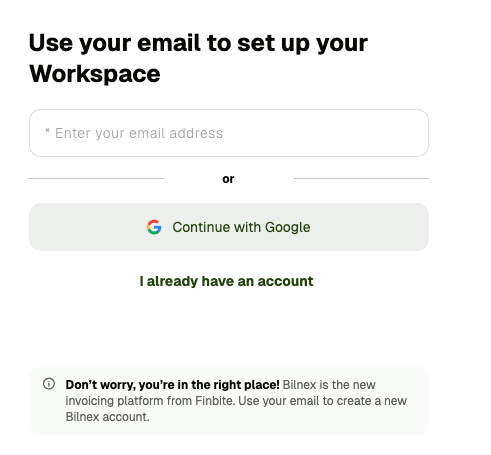

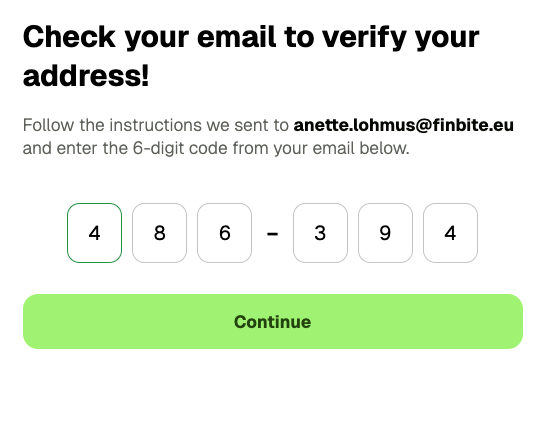

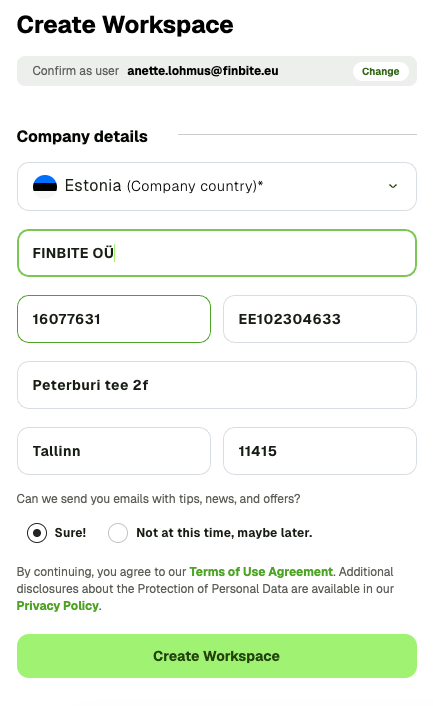

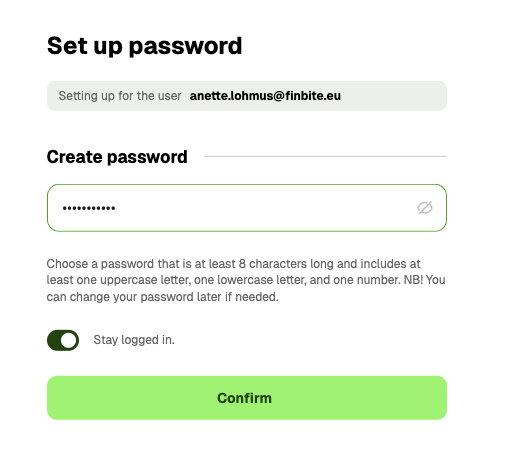

Open Bilnex web application, enter your email address or sign up with a Google account. We recommend using an email associated with your company. We will then send you a verification code to verify your email address.

Once the address is confirmed, add company details and choose a password.

Now you are ready to send your first invoice!

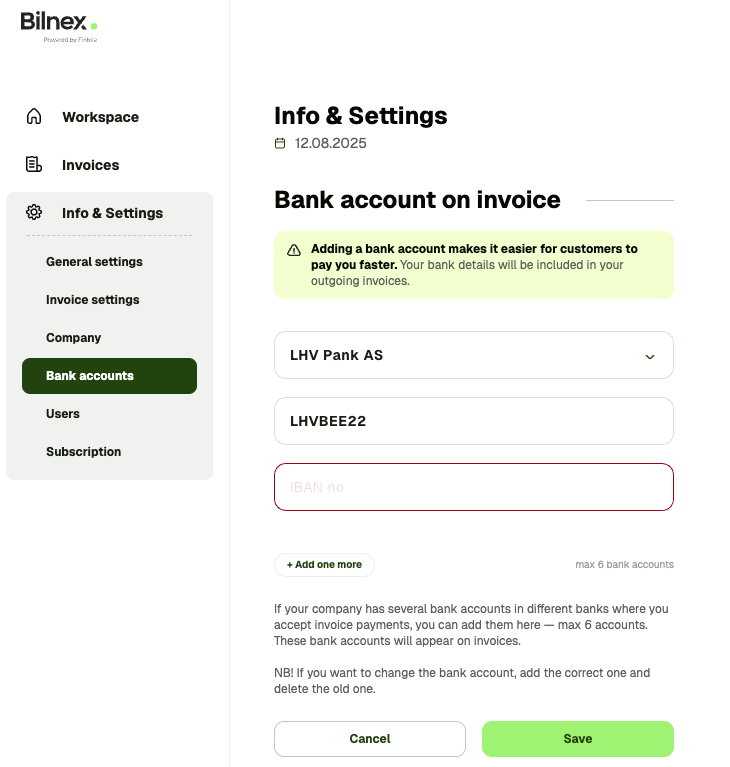

Although you can send the invoice to the customer before you have added the bank account details, we strongly recommend that you do this step as soon as possible. You can do the initial bank account settings from the Workspace or Info & Settings-> Bank Account below. Once your bank details are added, they will automatically appear on every invoice you submit. This way, the buyer will immediately know where to make the payment.

You can link up to 6 bank accounts to your company account.

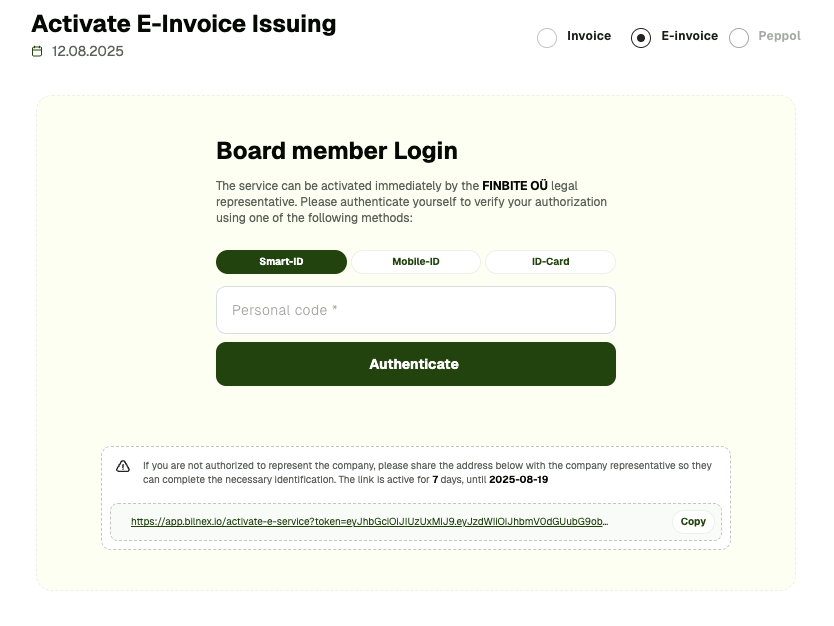

Before using e-invoices, they must be activated by a member of the management who is listed on the company's B-card in the business register. This can be done from the Workspace or when starting to create your first e-invoice.

Activation is done securely with Smart-ID, Mobile-ID or ID card.

If the account creator is not a board member, a special link can be sent to the board member to activate e-invoices, through which they can provide authentication.

Sending e-invoices must be activated in advance by a board member to prevent invoice fraud. Bilnex automatically checks the activation confirmation against the company's B-card in the business register. This way, we can ensure that no one can start submitting fraudulent e-invoices under your company's name.

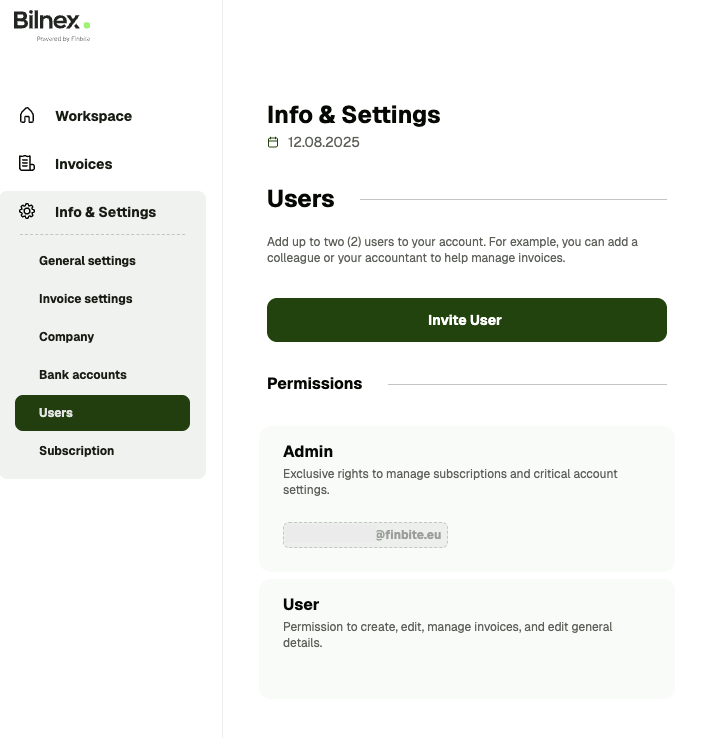

In addition to the Main User (Administrator), up to 2 more users can be added to one company.

Adding users works like this - Administrator selects from the menu Info & Settings → Users → Invite User, enters an email address and sends an invitation.

The new user will receive an invitation link via email and can join directly through it.

Invoicing and settings

Bilnex makes sending e-invoices and PDF invoices fast and easy. Learn how to create and send invoices, choose the right format, and adjust invoice settings.

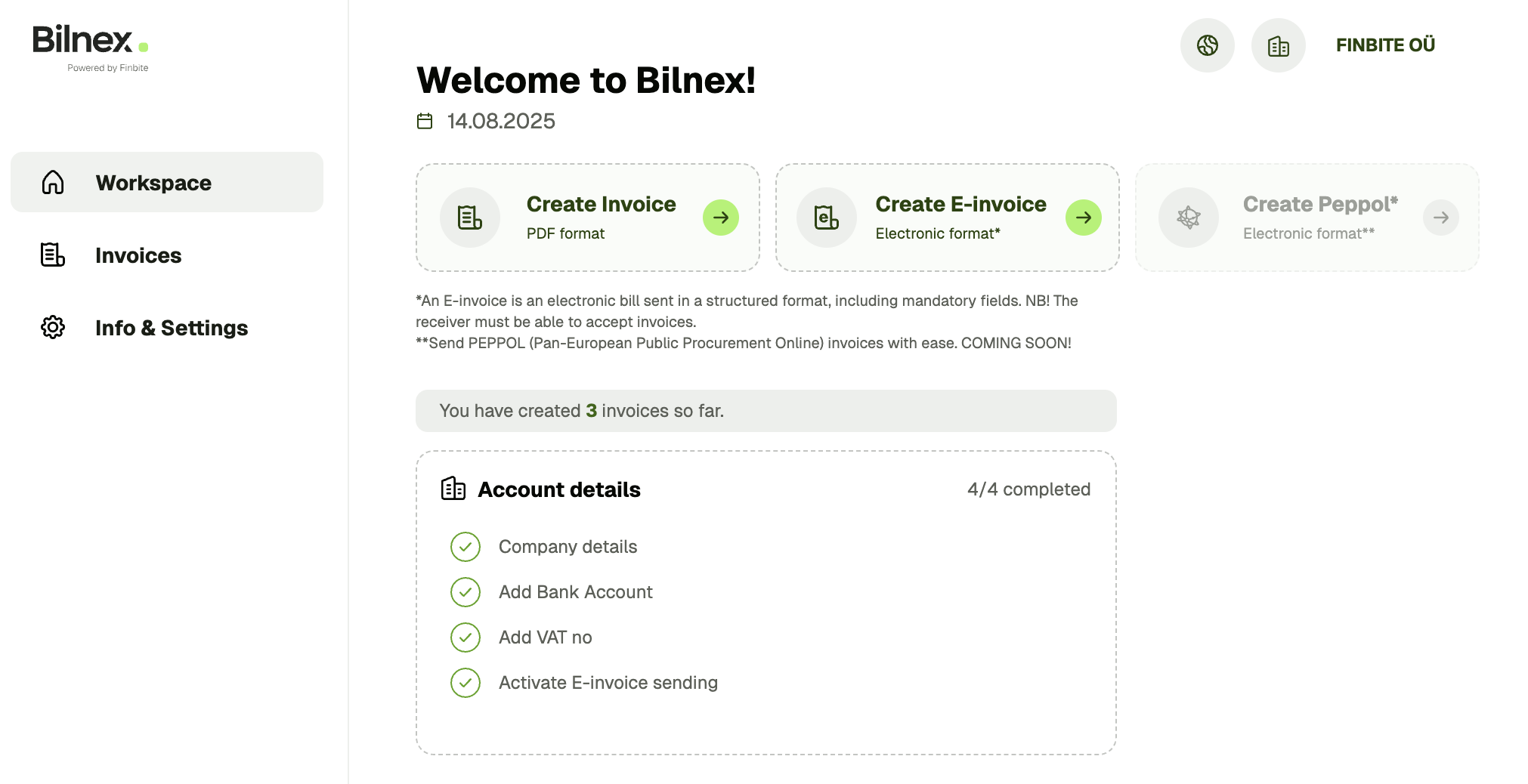

You can start creating an e-invoice. Workspace or Sales invoices from the menu.

Before you start, make sure that:

– company's bank account details have been entered

– sending e-invoices has been activated by a board member

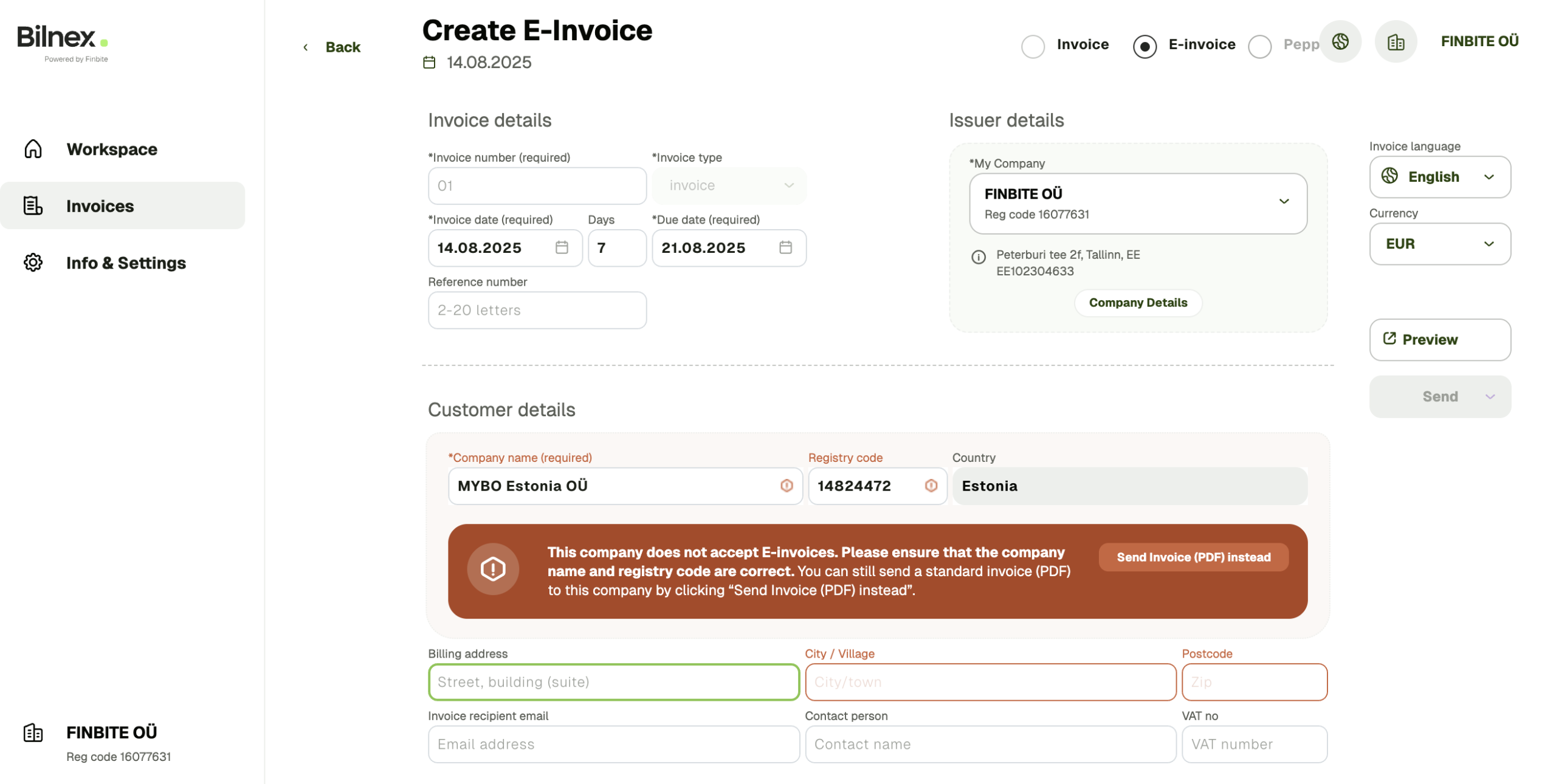

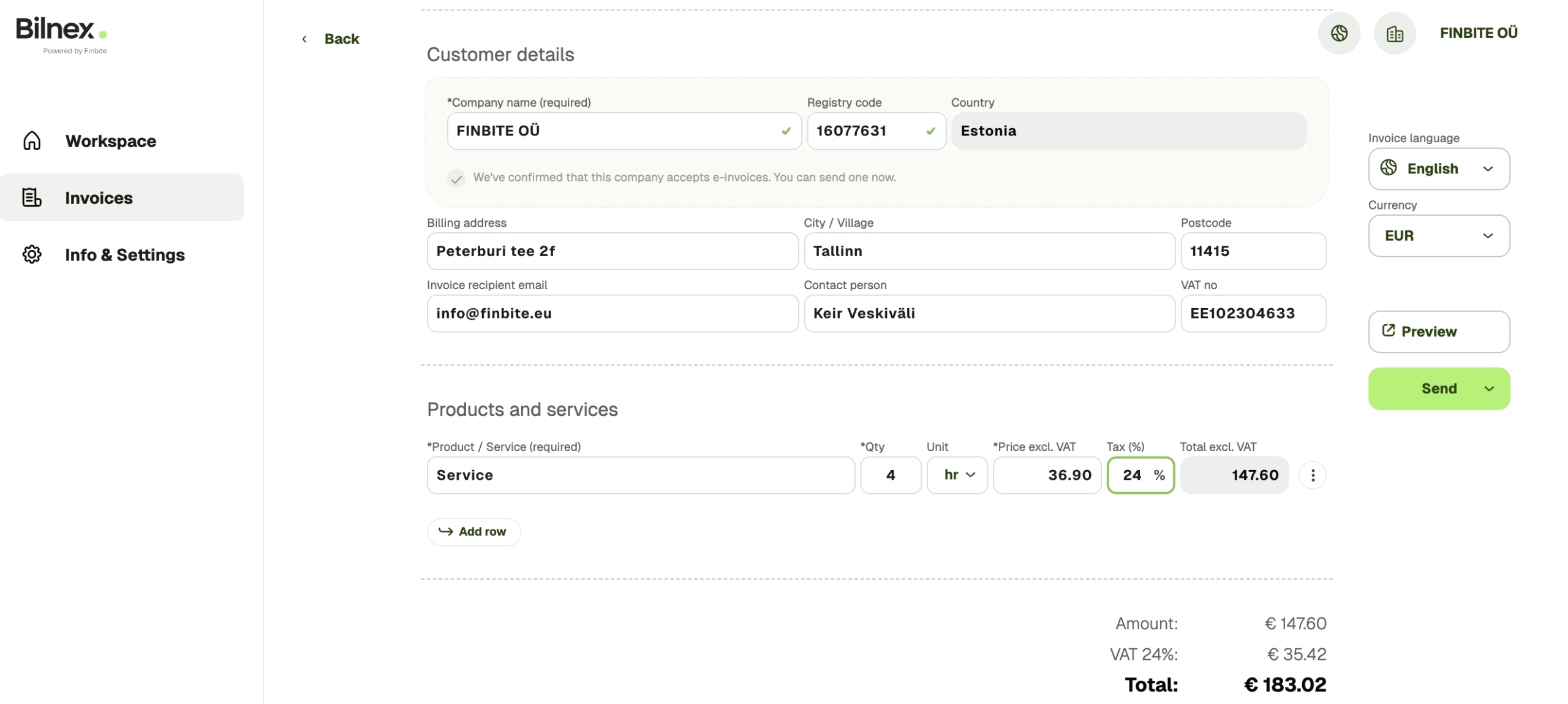

An e-invoice can only be created if the recipient of the invoice accepts e-invoices. When you enter the customer's name, Bilnex automatically checks the business register to see if the company accepts e-invoices. If not, you can convert the invoice to a PDF invoice with one click.

When the recipient receives e-invoices, the system automatically fills in the customer details.

Mandatory fields for e-invoice:

– Invoice number

– Date

– Payment term

– Service/product information

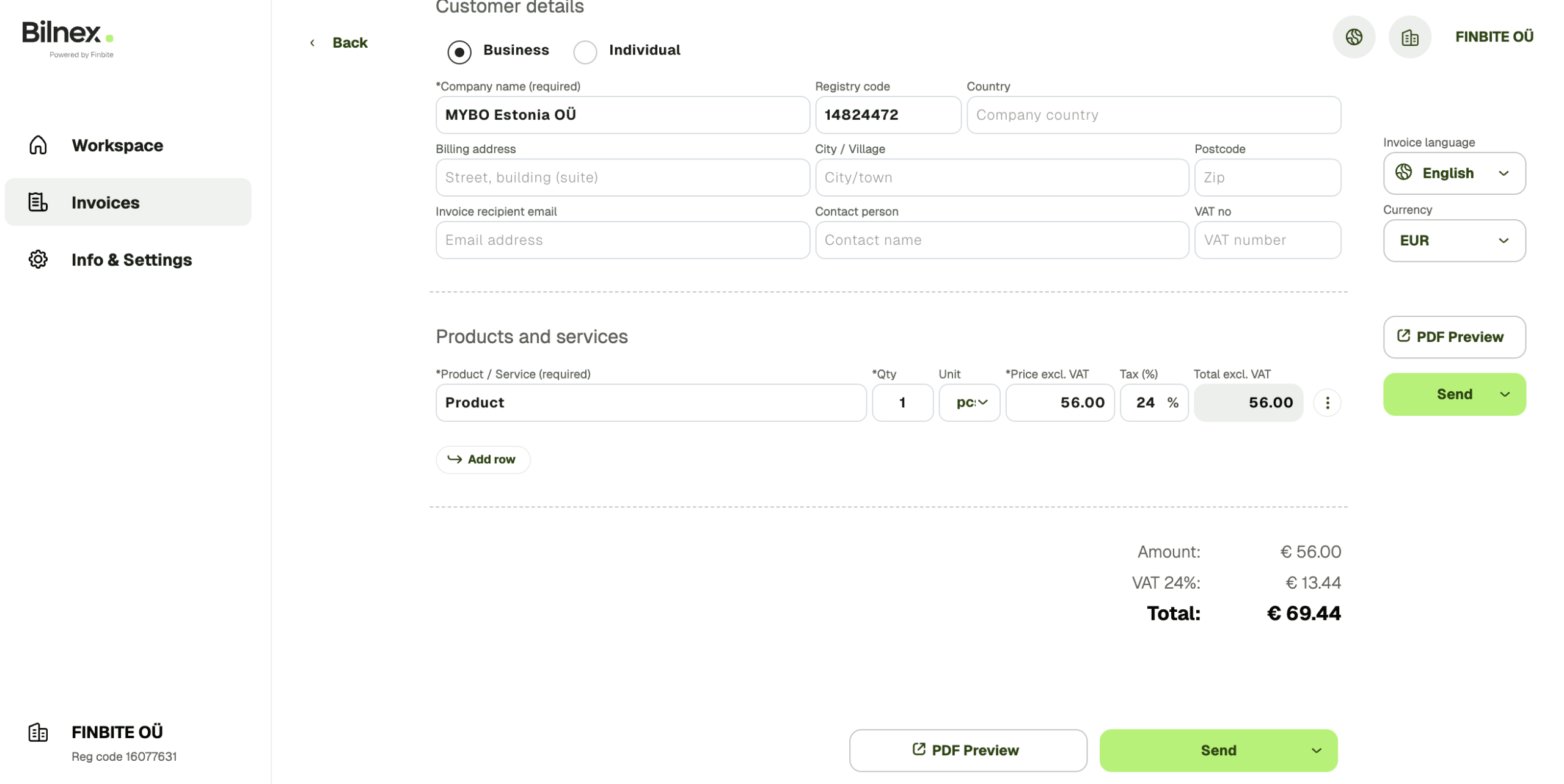

Add quantity, unit, price excluding VAT and VAT percentage to the service/product line – Bilnex will calculate all amounts itself: amount excluding VAT, VAT amount and total amount.

You can preview the e-invoice in the PDF view before sending it.

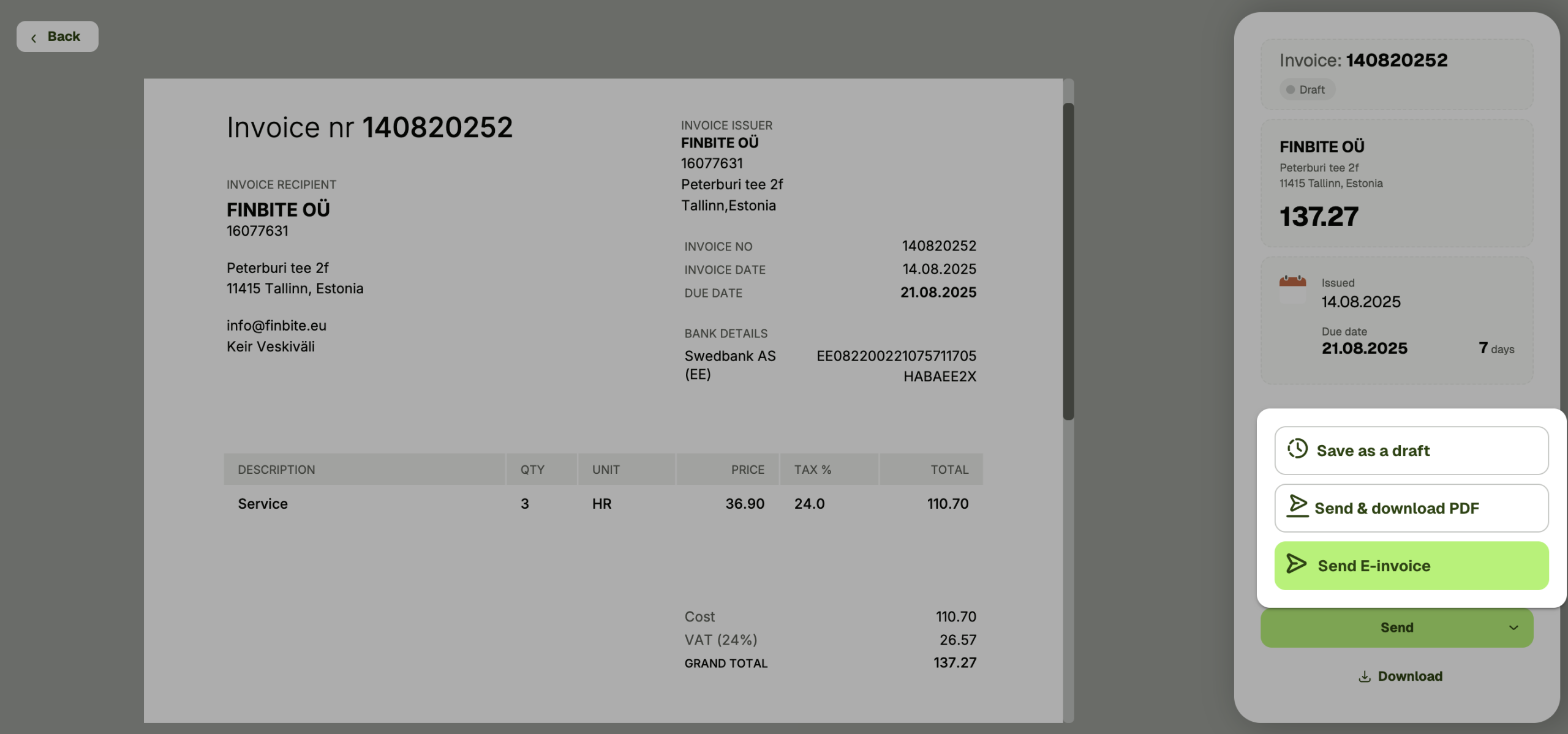

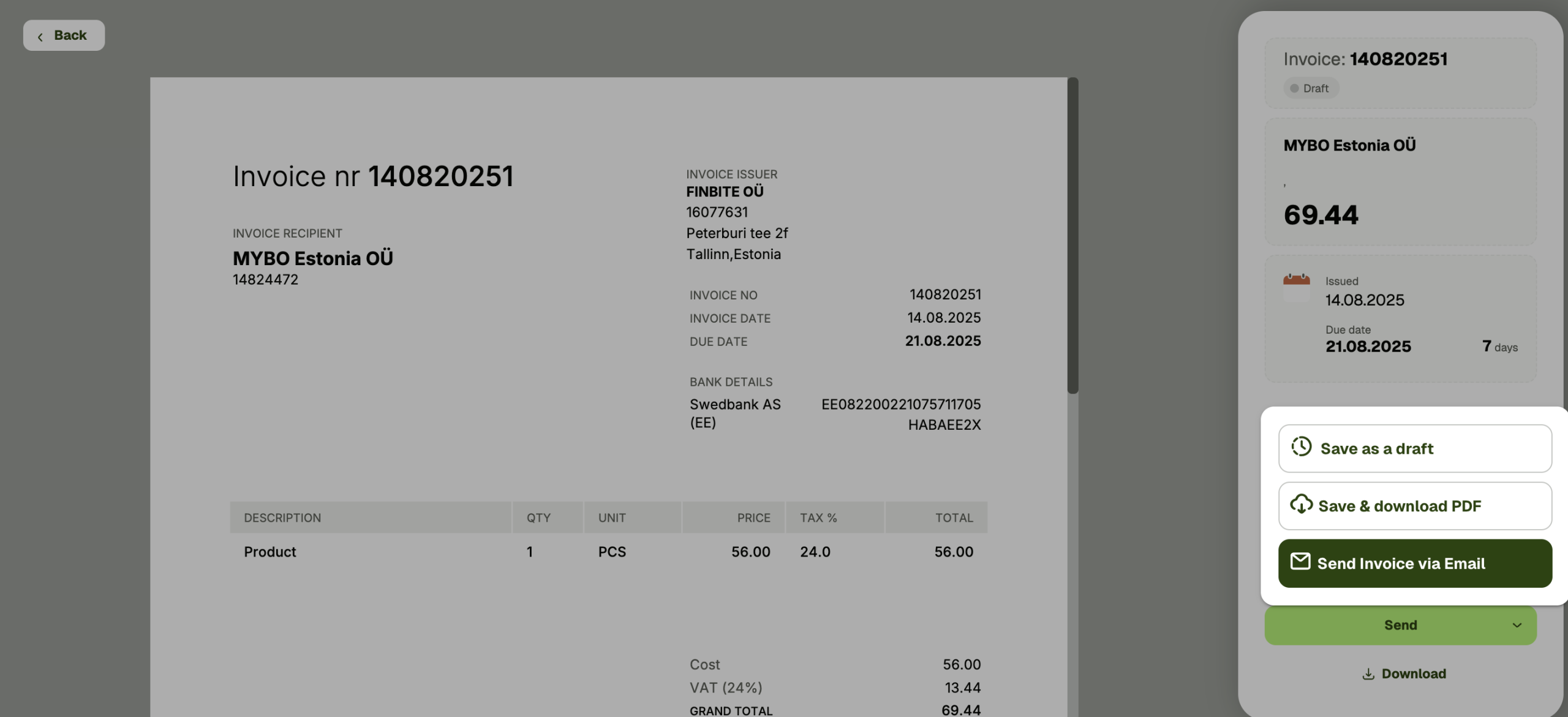

You have three options when sending an invoice:

– Save as draft (will not be sent)

– Send and download PDF image

– Send only as e-invoice (without downloading)

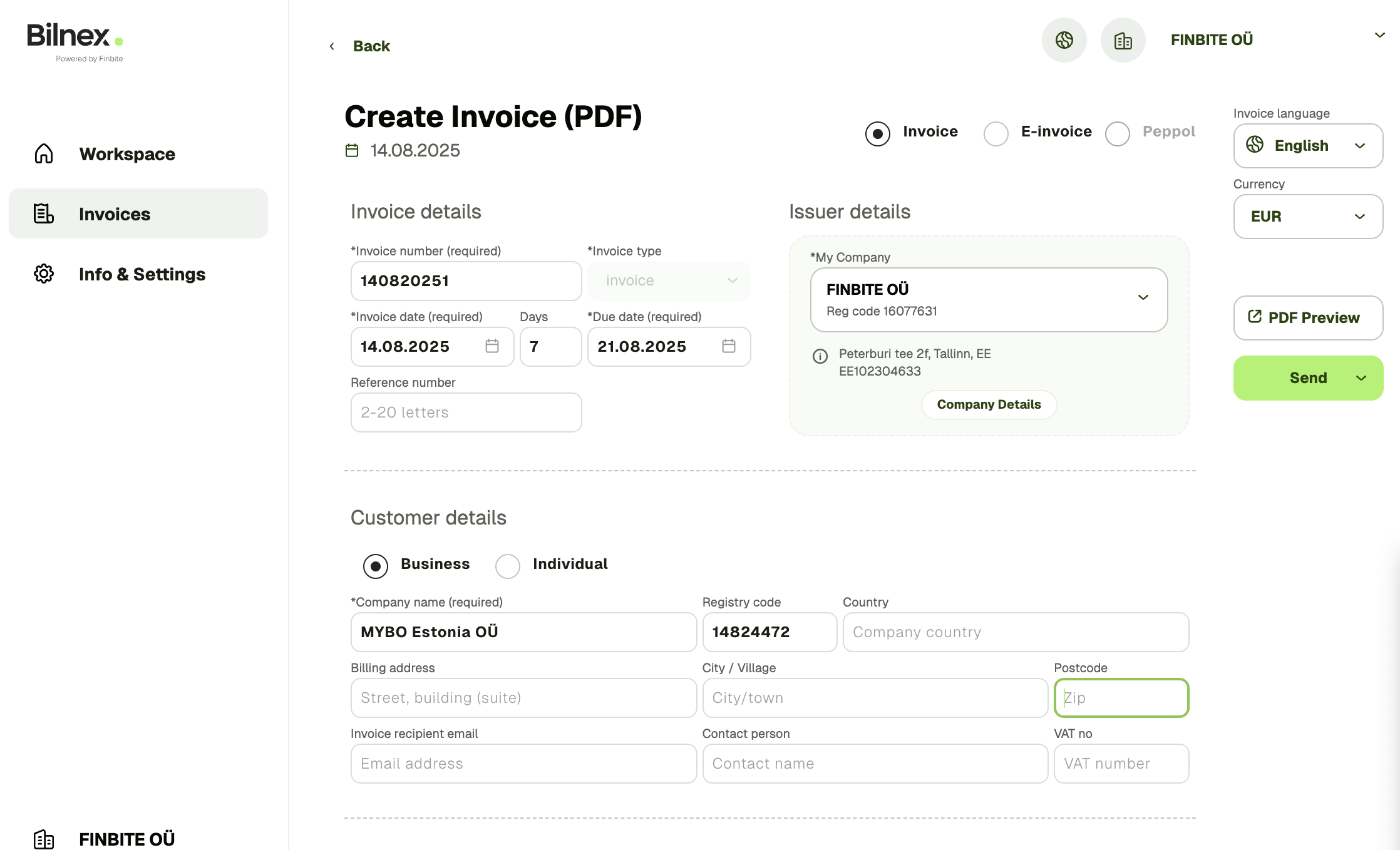

You can start creating a PDF invoice Workspace or Sales invoices from the menu by selecting Create new invoice.

Although entering bank account details is not mandatory, we recommend adding them before starting to create an invoice - this way, the invoice will always automatically indicate where the payment is expected.

PDF invoices can be created for all companies.

– If the company is entered in the Estonian Business Register, Bilnex will automatically fill in the customer's data partially or completely.

– If the customer is a foreign company, you can enter the data manually. In this case, we recommend changing the invoice language to English as well.

– When you create a recurring invoice, the Bilnex environment remembers the buyer's details and automatically fills in the information the next time.

Required fields for the invoice:

– Invoice number

– Date

– Payment term

– Service/product information

Add quantity, unit, price excluding VAT and VAT percentage to the service/product line – Bilnex will calculate all amounts itself: amount excluding VAT, VAT amount and total amount.

You can preview the invoice before sending it.

You have three options when sending an invoice:

– Save as draft (will not be sent)

– Save and download PDF view

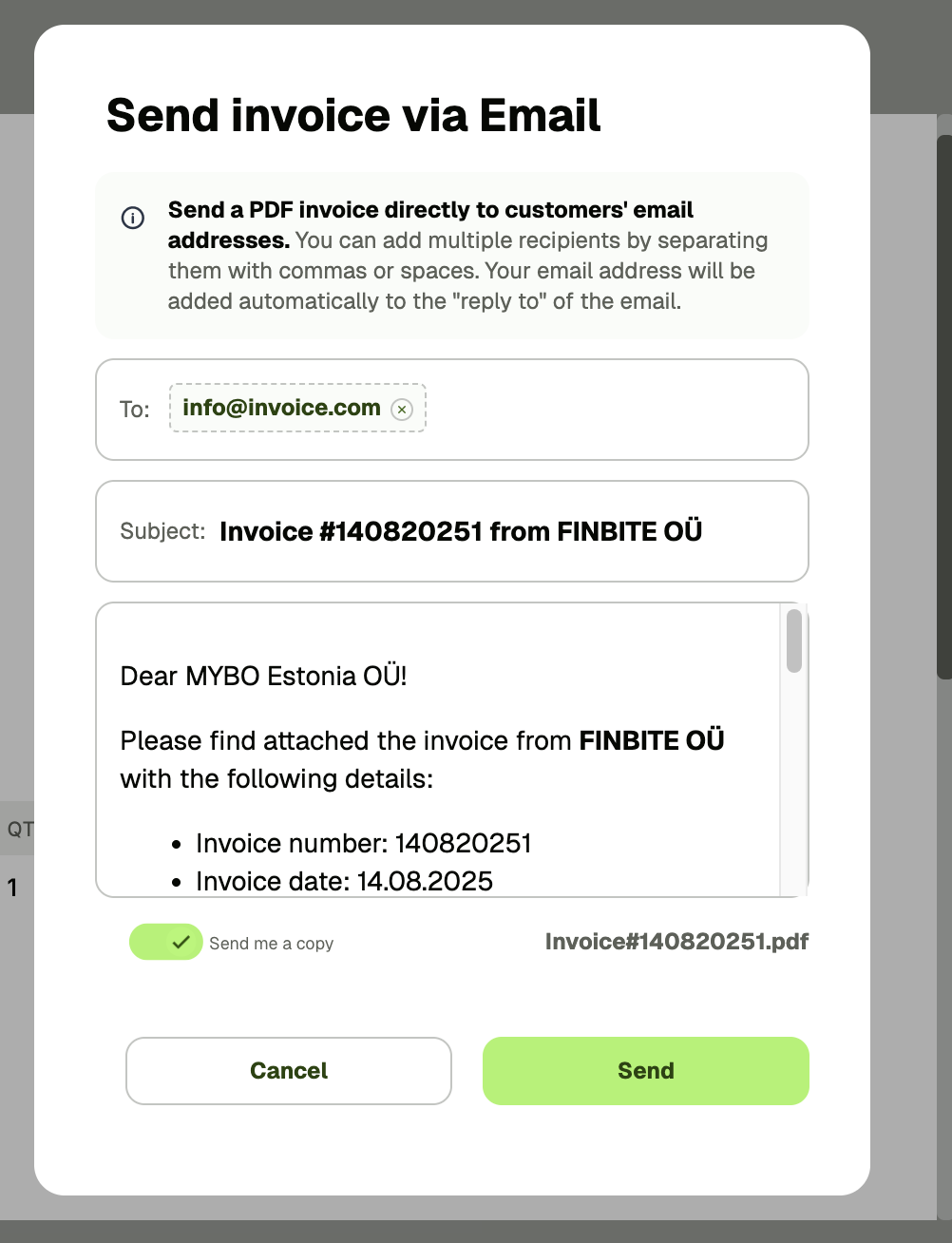

– Send invoice by email

When sending by email, you will see an automatically generated letter, which you can edit if you wish. You can also choose whether you want a copy of the e-mail to be sent to your email address.

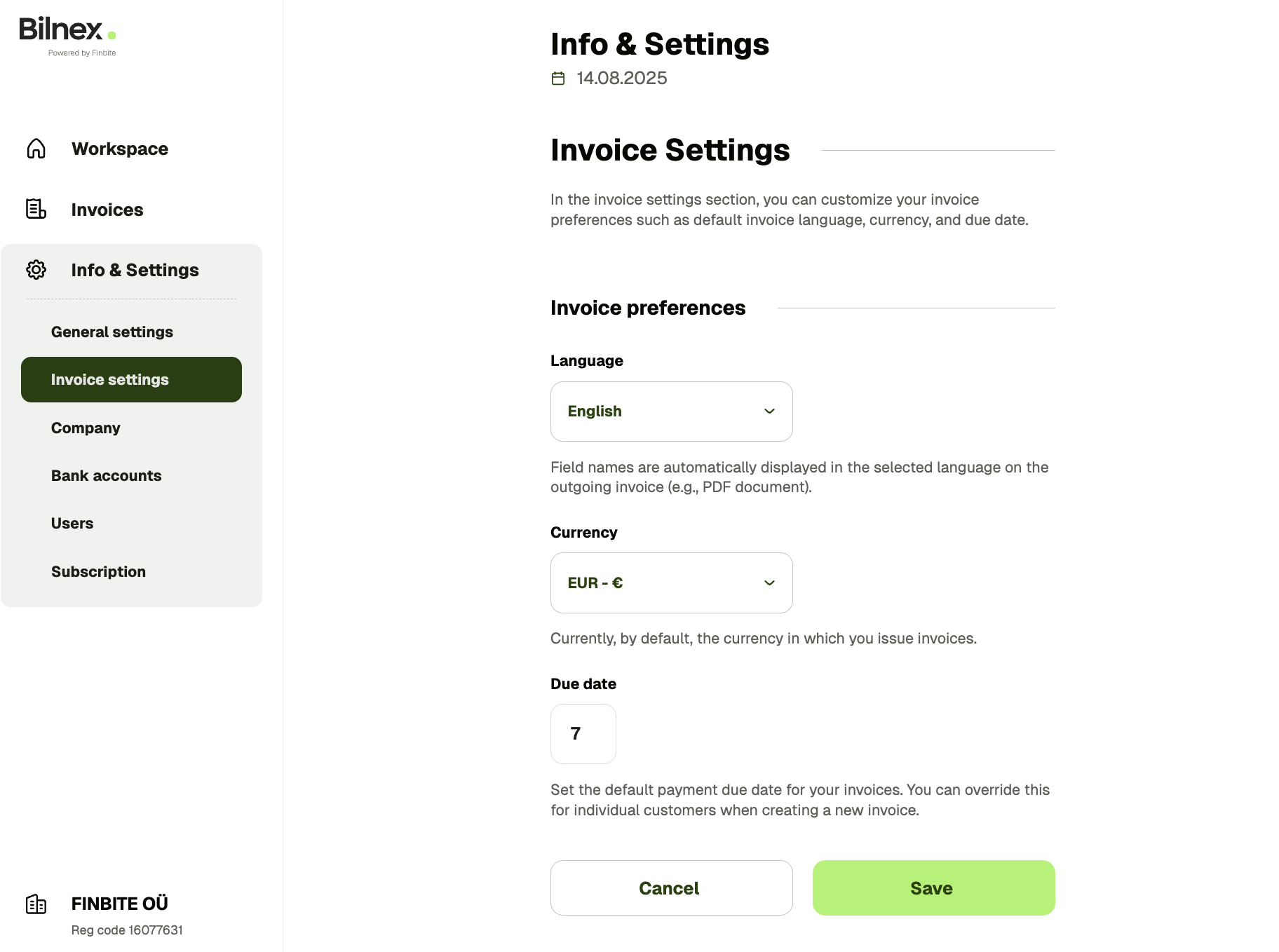

You can change the default invoice settings in the menu under Info & Settings → Invoice Settings.There you can choose which language, currency, and payment terms apply when creating new invoices.

If you wish, you can also change these settings for each invoice separately, in the invoice creation view.

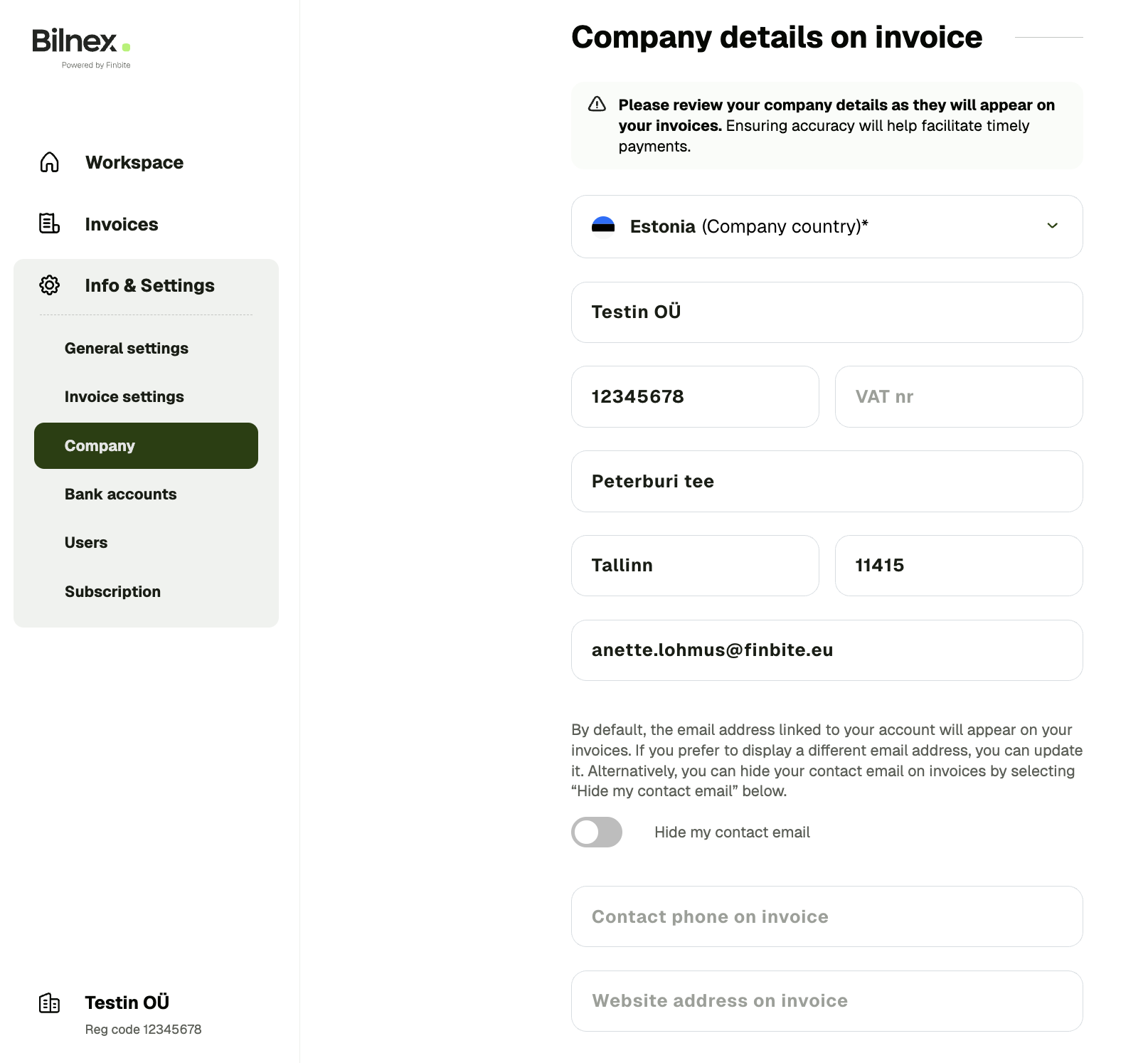

The seller's company details are automatically added to the invoice - you don't have to enter them manually each time.

You can edit contacts and other information in the menu under Info & Settings → Company. There you can add or change, for example:

– a generic billing email address that appears on invoices instead of the user's personal email

– contact phone number

– website address

General

Here you will find answers to more general questions.

Yes! Using Bilnex is completely free until the end of 2025. You can send as many PDF and e-invoices as you like — it won’t cost a thing.

We’ll inform you about future pricing and plans well in advance, so there won’t be any surprises. Our promise is to keep Bilnex simple, affordable, and user-friendly.

Sending e-invoices isn’t mandatory. However, if a buyer is listed as an e-invoice recipient, they have the right to demand e-invoices. In that case, the seller is expected to issue an e-invoice — unless both parties have agreed to use a different format. At Bilnex, we believe billing should be simple and convenient for everyone, no matter the format.

At Bilnex, we believe that billing should be as convenient as possible for all parties, regardless of the format.

You can reach us at support@bilnex.io – we aim to respond as quickly as possible.

Just create your sales invoice in the right format and send it out in minutes.